- News

- Business News

- India Business News

- Stock market crash: LIC’s stock portfolio takes a Rs 1.5 lakh crore hit in 2025 as markets bleed

Trending

Stock market crash: LIC’s stock portfolio takes a Rs 1.5 lakh crore hit in 2025 as markets bleed

LIC, India's largest investor, saw its equity portfolio drop by Rs 1.45 lakh crore in the first two months of 2025 due to a market crash, especially in small, mid-caps, and major stocks like ITC, TCS, and Infosys.

Stock market crash impact: Life Insurance Corporation of India (LIC), the country’s largest domestic institutional investor, has experienced a substantial decline of Rs 1.45 lakh crore in its equity portfolio value within two months of 2025. The value decreased from Rs 14.9 lakh crore in December 2024 to Rs 13.4 lakh crore by February's end, representing one of the most significant mark-to-market losses in its recent history for its diverse 310-stock portfolio.

According to an ET analysis, the severe decline in LIC's investments directly correlates with the overall market crash, particularly affecting small and mid-cap shares, which have experienced their most significant decline since the COVID-19 crisis. Large-cap shares, where LIC maintains considerable investments, have also experienced substantial losses.

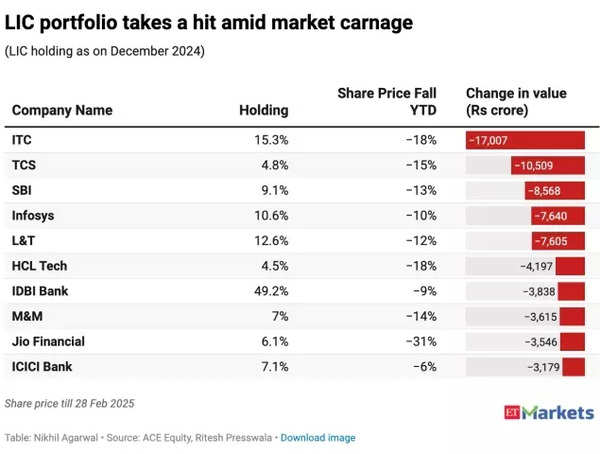

ITC, LIC's second-largest equity investment, has contributed significantly to the portfolio's decline, with an 18% decrease resulting in approximately Rs 17,000 crore value reduction. Technology companies TCS and Infosys, where LIC maintains 4.75% and 10.58% ownership respectively, have declined, reducing the portfolio value by Rs 10,509 crore and Rs 7,640 crore, according to ACE Equity data.

LIC Portfolio takes a hit

Also Read | ‘You are better off…’: Zerodha's Nithin Kamath shares SIP mantra amidst stock market crash doom and gloom

LIC maintains equity positions in more than 310 companies with minimum 1% ownership stakes, with widespread losses across holdings. The decline affects major financial institutions, technology leaders and industrial companies, reflecting the broader market downturn on Dalal Street.

The insurer has witnessed losses exceeding Rs 1,000 crore in at least 35 stock positions this year.

Key holdings in LIC's portfolio include Reliance Industries (₹1,03,727 crore), ITC (₹75,780 crore), Infosys (₹67,055 crore), HDFC Bank (₹62,814 crore), TCS (₹59,857 crore), SBI (₹55,597 crore), and L&T (₹54,215 crore).

Several investments have shown positive performance, including Bajaj Finance, Kotak Mahindra Bank, Maruti Suzuki, Bajaj Finserv, and SBI Cards, despite the overall market decline.

The ongoing market instability and persistent selling pressure raise questions about potential further losses in LIC's investments. Despite the insurer's historical resilience to market fluctuations, continued FII selling and weakness in small and mid-cap sectors suggest sustained challenges ahead.

Also Read | Stock market crash: Mayhem in smallcap and midcap stocks! What should investors do?

Analysts note that Nifty's 16% decline from peak levels has brought its TMM PE multiple below 20 for the first time in 32 months, indicating more reasonable valuations.

Market recovery depends significantly on FII sentiment improvement. Recent months have seen FIIs sell Indian equities worth over Rs 3 lakh crore in the cash segment.

Various financial institutions offer different market perspectives. Kotak Institutional Equities anticipates range-bound Nifty movement this year. Citi Research projects recovery to 26,000 by December 2025, suggesting 13% potential gains. Morgan Stanley predicts India will outperform emerging markets, supported by economic stability and increasing consumption.

The market's ongoing volatility through 2025 will test LIC's investment strategy and its ability to maintain policyholder returns.

About the Author

TOI Business DeskEnd of Article

FOLLOW US ON SOCIAL MEDIA